What's the most i can borrow for a mortgage

Essentially if there is no mortgage and no. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

5 Things Not To Do During The Mortgage Process It Doesn T Mean You Definitely Won T Get Approved For The Loan But Informative Mortgage Process How To Apply

Web When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less.

. Ad Compare Your Best Mortgage Loans View Rates. The maximum you could borrow from. This mortgage calculator will show how much you can afford.

Web To determine the most you can borrow for a VA loan the mortgage lender may use a specific DTI cutoff or threshold. They can also handle it on a case-by-case basis allowing. The up-front premium is calculated based on the homes value so for every 100000 in appraised value you pay.

Ad See Todays Rate Get The Best Rate In A 90 Day Period. Web The equity portion can be 100 if you have no mortgage and have either paid out your mortgage or paid for your house in cash. Lenders will typically use an income multiple of 4-45 times salary per person.

Compare Lowest Mortgage Lender Rates 2022. Ad Lock Your Mortgage Rate With Award-Winning Quicken Loans. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income.

Web How much can I borrow for a mortgage is the most commonly asked question among first-time borrowers. Web You typically need a minimum deposit of 5 to get a mortgage. Generally speaking you may have trouble finding a mortgage below about 60000.

Web How Many Times My Salary Can I Borrow For A Mortgage. Web And the most youll be able to borrow with a conventional mortgage would be 90 of the price which in your case would be 63000. FHA VA Conventional HARP And Jumbo Mortgages Available.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. You could borrow up to Borrowing amount 0 Deposit amount 0. Web A second mortgage is a loan secured by a property in addition to the primary mortgage.

Web The maximum you could borrow from most lenders is around. Web Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. Web There are two different ways you can repay your mortgage.

Find out more about the fees you may need to pay. Web Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. Updated Rates for Today.

Web Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to. Web Calculate what you can afford and more. Ad Top-Rated Mortgage Companies 2022.

Ad Are you eligible for low interest rates. Find A Lender That Offers Great Service. And the most youll be able to borrow with a.

Compare More Than Just Rates. Fill in the entry. With a capital and interest option you pay off the loan as well as the interest on it.

Get the Right Housing Loan for Your Needs. Find all FHA loan requirements here. Capital and interest or interest only.

The first step in buying a house is determining your budget. Compare More Than Just Rates. Web Now all borrowers pay the same 20 rate.

Find A Lender That Offers Great Service. Compare Offers Side by Side with LendingTree. Web How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

Lenders will typically use an income. Broadly speaking most lenders will allow. Get competitive quotes from.

Get Top-Rated Mortgage Offers Online. Depending on the value of the property and existing mortgage you can obtain finance. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Fill in the entry fields. Web When it comes to loan amounts most lenders dont disclose their minimums. Web And the most youll be able to borrow with a conventional mortgage would be 90 of the price which in your case would be 63000.

Web In general most people can expect to borrow between 3 and 4 times their annual income when applying for a mortgage. Our mortgage calculator can give you a. For example if you.

That can greatly impact your decision on whether to choose a. Web In general most people can expect to borrow between 3 and 4 times their annual income when applying for a mortgage. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Web The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

Mortgage Pre Approval Means A Lender Has Reviewed Your Finances And Determined How Much You Re Qualifie Preapproved Mortgage Credit History Home Buying Process

Tips On How To Co Sign Responsibly Build Credit Best Credit Cards Credit Card Offers

Your Credit Score Demystified Visual Ly Mortgage Loans Home Buying Process Home Buying

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Home Equity Loan Home Improvement Loans

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Pin Page

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

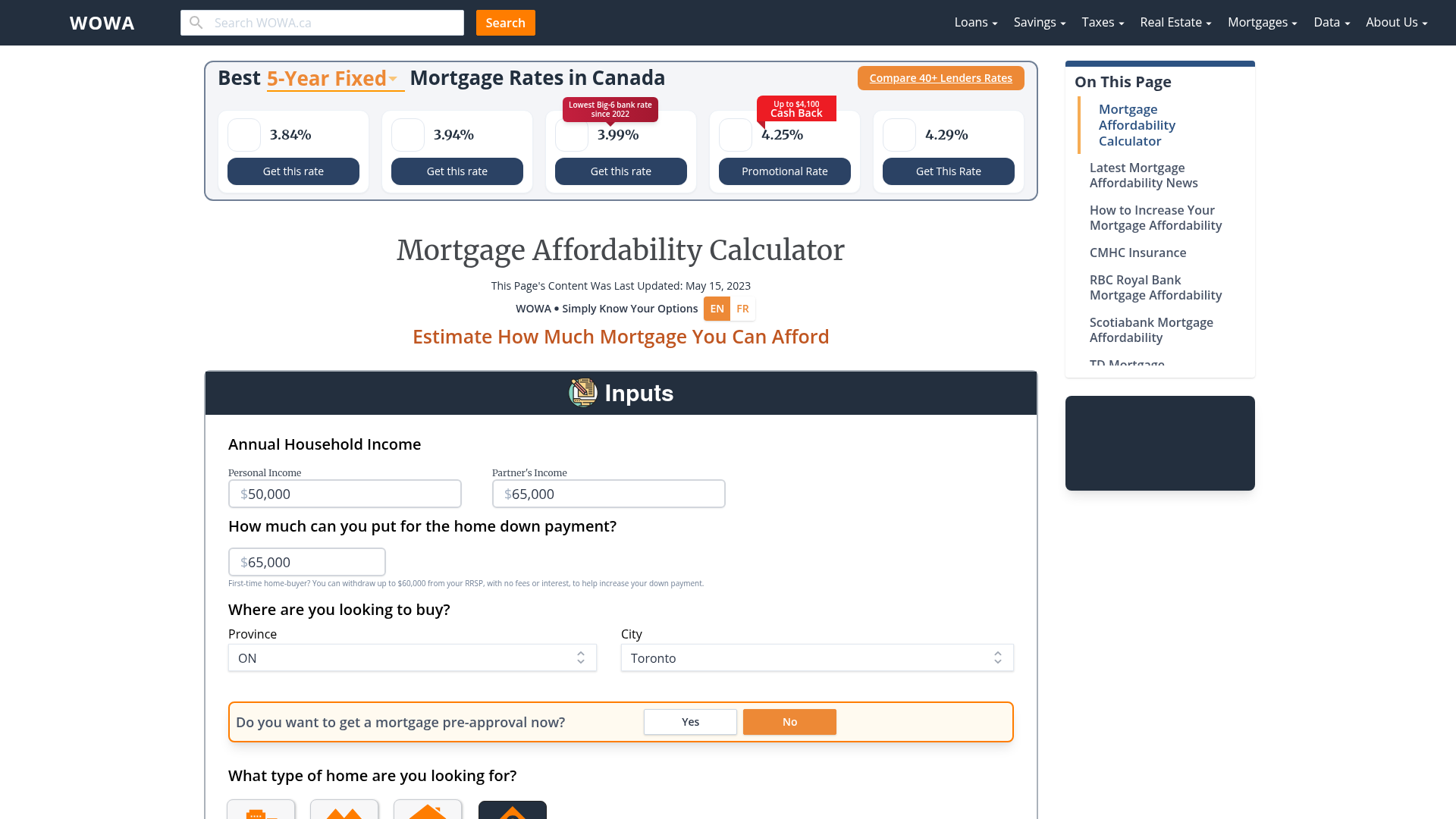

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Mortgage Loans

Definition Time Today S Mortgage Vocab Is Annual Percentage Rate Apr In 2022 Mortgage Brokers Mortgage Tips The Borrowers

Tips For Repaying Your Payday Loan Payday Loans Payday Best Payday Loans

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Mortgage Refinancing Infographic Mortgage Infographic Refinancing Mortgage Mortgage

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Ultimate Home Buyers Checklist Save Time Money House Down Payment Home Financing Mortgage Loans

5 Things You Need To Be Pre Approved For A Mortgage In 2022 Mortgage Financial Tips Budget Planning